Prologue

- The tax exemption threshold has been raised to ₹12 lakh, providing relief to middle-class taxpayers. The standard deduction for salaried employees has also increased to ₹75,000, boosting disposable income.

- The government has retained a capital expenditure target of ₹11.11 lakh crore to strengthen infrastructure, with major allocations for highways, railways, and urban development.

- The PM Dhan-Dhaanya Krishi Yojana targets 100 districts to benefit 1.7 crore farmers. Additionally, ₹20,000 crore has been allocated to private sector-led research, development, and innovation.

Budget Estimates 2025-26

- Expenditure: The government is estimated to spend Rs 50,65,345 crore in 2025-26, 7.4% higher than the revised estimate of 2024-25. Interest payments account for 25% of the total expenditure, and 37% of revenue receipts.

- Receipts: The receipts (other than borrowings) in 2025-26 are estimated to be Rs 34,96,409 crore, about 11.1% higher than the revised estimate of 2024-25. Tax revenue which forms major part of the receipts is also expected to increase by 11% over the revised estimate for 2024-25.

- GDP: The government has estimated a nominal GDP growth rate of 10.1% in 2025-26 (i.e., real growth plus inflation).

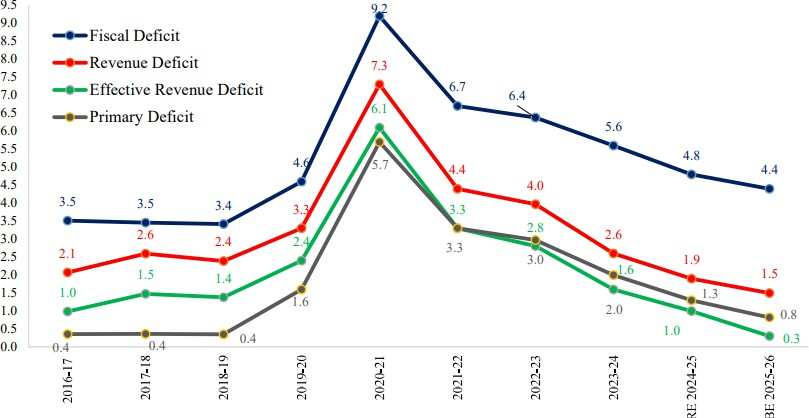

- Deficits: Revenue deficit in 2025-26 is targeted at 1.5% of GDP. This is lower than the revised estimate of 1.9% in 2024- 25. Fiscal deficit in 2025-26 is targeted at 4.4% of GDP, lower than the revised estimate of 4.8% of GDP in 2024-25.

- Debt: The central government aims to reduce its outstanding liabilities to around 50% of GDP by March 2031. In 2025-26, outstanding liabilities are estimated to be 56.1% of the GDP

The Budget outlines sustained efforts focused on the following priorities:

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, outlines a strategic roadmap for India’s economic growth, fiscal management, and social development. With a strong focus on infrastructure, innovation, rural welfare, and job creation, the budget aims to sustain economic momentum while ensuring inclusive development. Key highlights include tax relief for individuals, enhanced agricultural support, increased capital expenditure, and incentives for research and manufacturing. Emphasizing self-reliance and sustainability, the budget seeks to balance fiscal consolidation with economic expansion, positioning India for long-term growth and global competitiveness.

Engines of Development

The Union Budget 2025 lays the foundation for India’s long-term economic growth by prioritizing key sectors that drive national development. The budget focuses on multiple “engines of development” to stimulate economic expansion, create jobs, improve infrastructure, and ensure social welfare. These engines are as follows:

AGRICULTURE AS THE 1st ENGINE OF DEVELOPMENT

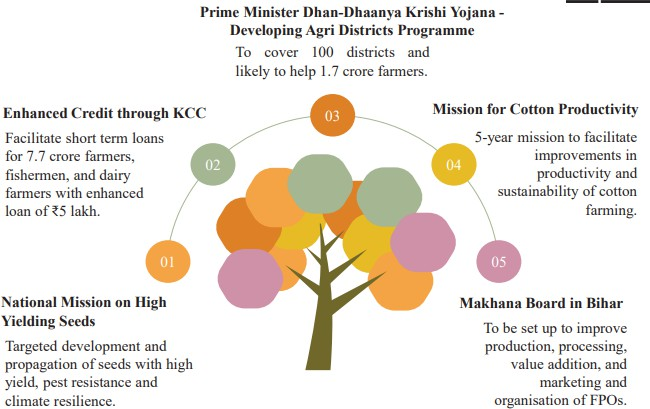

- Prime Minister Dhan-Dhaanya Krishi Yojana – Developing Agri Districts Programme – The programme to be launched in partnership with the states, covering 100 districts with low productivity, moderate crop intensity and below-average credit parameters, to benefit 1.7 crore farmers.

- Building Rural Prosperity and Resilience – A comprehensive multi-sectoral programme to be launched in partnership with states to address underemployment in agriculture through skilling, investment, technology, and invigorating the rural economy. Phase-1 to cover 100 developing agri-districts.

- Aatmanirbharta in Pulses – Government to launch a 6-year “Mission for Aatmanirbharta in Pulses” with focus on Tur, Urad and Masoor. NAFED and NCCF to procure these pulses from farmers during the next 4 years.

- Comprehensive Programme for Vegetables & Fruits – A comprehensive programme to promote production, efficient supplies, processing, and remunerative prices for farmers to be launched in partnership with states.

- Nakhana Board in Bihar – A Makhana Board to be established to improve production, processing, value addition, and marketing of makhana.

- National Mission on High Yielding Seeds – A National Mission on High Yielding Seeds to be launched aiming at strengthening the research ecosystem, targeted development and propagation of seeds with high yield, and commercial availability of more than 100 seed varieties.

- Fisheries – Government to bring a framework for sustainable harnessing of fisheries from Indian Exclusive Economic Zone and High Seas, with a special focus on the Andaman & Nicobar and Lakshadweep Islands

- Mission for Cotton Productivity – A 5-year mission announced to facilitate significant improvements in productivity and sustainability of cotton farming, and promote extra-long staple cotton varieties.

- Enhanced Credit through KCC – The loan limit under the Modified Interest Subvention Scheme to be enhanced from ₹ 3 lakh to ₹ 5 lakh for loans taken through the KCC.

MSMEs AS THE 2nd ENGINE OF DEVELOPMENT

- Revision in classification criteria for MSMEs -The investment and turnover limits for classification of all MSMEs to be enhanced to 2.5 and 2 times respectively.

- Credit Cards for Micro Enterprises – Customized Credit Cards with ₹ 5 lakh limit for micro enterprises registered on Udyam portal, 10 lakh cards to be issued in the first year.

- Fund of Funds for Startups – A new Fund of Funds, with expanded scope and a fresh contribution of ₹ 10,000 crore to be set up.

- Scheme for First-time Entrepreneurs – A new scheme for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs to provide term-loans upto ₹ 2 crore in the next 5 years announced.

- Focus Product Scheme for Footwear & Leather Sectors – To enhance the productivity, quality and competitiveness of India’s footwear and leather sector, a focus product scheme announced to facilitate employment for 22 lakh persons, generate turnover of ₹ 4 lakh crore and exports of over ₹ 1.1 lakh crore.

- Measures for the Toy Sector – A scheme to create high-quality, unique, innovative, and sustainable toys, making India a global hub for toys announced.

- Support for Food Processing – A National Institute of Food Technology, Entrepreneurship and Management to be set up in Bihar.

- Manufacturing Mission – Furthering “Make in India” A National Manufacturing Mission covering small, medium and large industries for furthering “Make in India” announced.

INVESTMENT AS THE 3rd ENGINE OF DEVELOPMENT

- The broadband connectivity will be provided to all Government secondary schools and primary health centres in rural areas under the Bharatnet project.

- Under the investment in people, she announced that 50,000 Atal Tinkering Labs will be set up in

- Government schools in next 5 years.

- Defining Investment as the third engine of growth, the Union Minister prioritized investment in people,

- economy and innovation.

- Bharatiya Bhasha Pustak Scheme will be implemented to provide digital-form Indian language books for school and higher education.

- Five National Centres of Excellence for skilling will be set up with global expertise and partnerships to equip our youth with the skills required for “Make for India, Make for the World” manufacturing.

- A Centre of Excellence in Artificial Intelligence for education will be set up with a total outlay of 500 crore.

- Budget announced that Government will arrange for Gig workers’ identity cards, their registration on the e-Shram portal and healthcare under PM Jan Arogya Yojana.

- Under the investment in Economy, Infrastructure-related ministries will come up with a 3-year pipeline of projects in PPP mode.

- She added that an outlay of Rs 1.5 lakh crore was proposed for the 50-year interest free loans to states for capital expenditure and incentives for reforms.

- It was also announced the second Asset Monetization Plan 2025-30 to plough back capital of Rs 10 lakh crore in new projects.

- The Jal Jeevan Mission was extended till 2028 with focus on the quality of infrastructure and Operation & Maintenance of rural piped water supply schemes through “Jan Bhagidhari”.

- Government will set up an Urban Challenge Fund of Rs.1 lakh crore to implement the proposals for ‘Cities as Growth Hubs’, ‘Creative Redevelopment of Cities’ and ‘Water and Sanitation’.

- Under the investment in Innovation, an allocation of ₹20,000 crore is announced to implement private sector driven Research, Development and Innovation initiative.

- Finance Minister proposed National Geospatial Mission to develop foundational geospatial infrastructure and data which will benefit urban planning.

- Budget proposes Gyan Bharatam Mission, for survey, documentation and conservation of more than 1 crore manuscripts with academic institutions, museums, libraries and private collectors. A National Digital Repository of Indian knowledge systems for knowledge sharing is also proposed.

EXPORTS AS THE 4th ENGINE OF DEVELOPMENT

- Export Promotion Mission – An Export Promotion Mission, with sectoral and ministerial targets, driven jointly by the Ministries of Commerce, MSME, and Finance to be set up.

- BharatTradeNet – ‘BharatTradeNet’ (BTN) for international trade to be set-up as a unified platform for trade documentation and financing solutions.

- National Framework for GCC – A national framework to be formulated as guidance to states for promoting Global Capability Centres in emerging tier 2 cities.

Reforms as the Fuel

- FDI in Insurance Sector – The FDI limit for the insurance sector to be raised from 74 to 100 per cent, for those companies which invest the entire premium in India.

- Credit Enhancement Facility by NaBFID – NaBFID to set up a ‘Partial Credit Enhancement Facility’ for corporate bonds for infrastructure.

- Grameen Credit Score – Public Sector Banks to develop ‘Grameen Credit Score’ framework to serve the credit needs of SHG members and people in rural areas.

- Pension Sector – A forum for regulatory coordination and development of pension products to be set up.

- High Level Committee for Regulatory Reforms – A High Level Committee for Regulatory Reforms to beset up for a review of all non-financial sector regulations, certifications, licenses, and permissions

DIRECT TAX

- No personal income tax payable upto income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime.

- This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of Rs 75,000.

- The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment.

- The new Income-Tax Bill to be clear and direct in text so as to make it simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation.

- Revenue of about ₹ 1 lakh crore in direct taxes will be forgone.

Revised tax rate structure

TDS/TCS rationalization for easing difficulties

- Rationalization of Tax Deduction at Source (TDS) by reducing number of rates and thresholds above which TDS is deducted.

- The limit for tax deduction on interest for senior citizens doubled from the present Rs 50,000 to Rs 1 lakh.

- The annual limit of Rs 2.40 lakh for TDS on rent increased to Rs 6 lakh.

- The threshold to collect tax at source (TCS) on remittances under RBI’s Liberalized Remittance Scheme (LRS) increased from Rs 7 lakh to Rs 10 lakh.

- The provisions of the higher TDS deduction will apply only in non-PAN cases. Decriminalization for the cases of delay of payment of TCS up to the due date of filing statement

INDIRECT TAX

Rationalisation of Customs Tariff Structure for Industrial Goods

Union Budget 2025-26 proposes to:

- Remove seven tariff rates. This is over and above the seven tariff rates removed in 2023-24 budget. After this, there will be only eight remaining tariff rates including ‘zero’ rate.

- Apply appropriate cess to broadly maintain effective duty incidence except on a few items, where such incidence will reduce marginally.

- Levy not more than one cess or surcharge. Therefore Social Welfare Surcharge on 82 tariff lines that are subject to a cess, exempted.

Relief on import of Drugs/Medicines

- 36 lifesaving drugs and medicines fully exempted from Basic Customs Duty (BCD).

- 6 lifesaving medicines to attract concessional customs duty of 5%.

- Specified drugs and medicines under Patient Assistance Programmes run by pharmaceutical companies fully exempted from BCD; 37 more medicines added along with 13 new patient assistance programmes.

Support to Domestic Manufacturing and Value addition

- To support Domestic Manufacturing and Value Addition, BCD on 25 critical minerals, that were not domestically available, were exempted in July 2024. The Budget 2025-26 fully exempts cobalt powder and waste, scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals. To promote domestic textile production, two more types of shuttle-less looms added to fully exempted textile machinery. Further, BCD on knitted fabrics covering nine tariff lines from “10% to 20%” revised to “20% or ₹ 115 kg, whichever is higher”.

Export promotion

- For export promotion, Budget 2025-26 facilitates exports of handicrafts, fully exempts BCD on Wet Blue leather for value addition and employment, reduce BCD from 30% to 5% on Frozen Fish Paste and reduce BCD from 15% to 5% on fish hydrolysate for manufacture of fish and shrimp feeds.

Trade facilitation

- Time limit for Provisional Assessment: For finalising the provisional assessment, time-limit of two years fixed, extendable by a year.

- Voluntary Compliance: A new provision introduced to enable importers or exporters, after clearance of goods, to voluntarily declare material facts and pay duty with interest but without penalty.

- Extended Time for End Use: Time limit for the end-use of imported inputs in the relevant rules extended from six months to one year. Such importers to file only quarterly statements instead of a monthly statement.

Budget estimates of 2025-26 as compared to revised estimates of 2024-25

- Total Expenditure: The government is estimated to spend Rs 50,65,345 crore in 2025-26. This is an increase of 7.4% over the revised estimate of 2024-25.

- Revenue expenditure is estimated to increase by 6.7% and capital expenditure by 10.1% over the revised estimate of 2024-25. Allocation towards major schemes – MGNREGS and PM-KISAN is the same as the revised estimates for 2024-25. Expenditure on subsidies is estimated to be similar to the revised estimate of 2024-25. Establishment expenditure (which includes pension and salary) is estimated to increase by 3% over the revised estimate of the previous year

- Total Receipts: Government receipts (excluding borrowings) are estimated to be Rs 34,96,409 crore, 11.1% higher than the revised estimate of 2024-25. The gap between these receipts and the expenditure will be plugged by borrowings, budgeted to be Rs 15,68,936 crore, roughly the same as the revised estimate of 2024-25.

- Transfer to states: The central government will transfer Rs 25,59,764 crore to states in 2025-26, an increase of 12.5% over the revised estimate of 2024-25. Transfer to states includes tax devolution of Rs 14,22,444 crore and grants worth Rs 11,37,320 crore. Within this Rs 1,50,000 crore have been allocated for capital expenditure loans.

- Deficits: Revenue deficit is targeted at 1.5% of GDP, lower than the revised estimate for 2024-25 (1.9% of GDP). Fiscal deficit is targeted at 4.4% of GDP in 2025-26, lower than the revised estimate for 2024- 25 (4.8% of GDP). The lower fiscal deficit is on account of higher growth in receipts at 11.1% as compared to expenditure growth at 7.4%.

- GDP growth estimate: The nominal GDP is estimated to grow at a rate of 10.1% in 2025-26.

Deficit Trends as % of GDP

- Deficits: Revenue deficit is targeted at 1.5% of GDP, lower than the revised estimate for 2024-25 (1.9% of GDP). Fiscal deficit is targeted at 4.4% of GDP in 2025-26, lower than the revised estimate for 2024-25 (4.8% of GDP). The lower fiscal deficit is on account of higher growth in receipts at 11.1% as compared to expenditure growth at 7.4%.

- GDP growth estimate: The nominal GDP is estimated to grow at a rate of 10.1% in 2025-26.

The Union Budget 2025 focuses on economic growth, fiscal stability, and self-reliance. It supports domestic manufacturing, infrastructure, and innovation through targeted incentives. Tax reforms and simplified compliance aim to enhance ease of doing business. Social welfare measures ensure inclusive development while maintaining fiscal prudence. Overall, the budget balances growth, sustainability, and global competitiveness.